you know the ones.

Hi there, world changer. I’m glad you’re here. I hope my words encourage you as a wife and mom and remind you that you’re not alone in your yes to God. It’s okay to be real and a little irreverent and mostly vulnerable in this safe space. Deep down, I think there’s a little bit of that family in all of us.

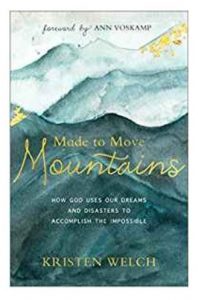

This blog has been a part of my family since 2008, which might make it an online antique at this point. While I don’t write here as much as I used to, this space has helped me process the parenting years, launch 6 books, and support the non-profit organization I started in 2010.